Financial success methodologies have evolved over the past 30 years with the advent of increasing computational power. Originally, planning was a simple spreadsheet projection of your current situation, plus some assumptions, such as savings rates, tax rates, investment returns and inflation rates. This would give you an idea of what your final destination would look like – with much of the calculations being driven by Future Value and Present Value tables.

Today, financial advisors can use powerful software to model a comprehensive financial strategy.

Strategy-Based planning, in broad terms, will consider your hopes and dreams, your personal and family lifestyle, and personal attitudes towards a range of preferences such as your willingness to work longer or harder. You can get as detailed as you wish in terms of cash flow expenses, tax planning and investment returns, etc.

This type of strategy is ideal for those clients who wish to get very precise answers to questions about their future. Or for those clients who have very complex affairs that require more analytical depth, such as the use of Trusts, Corporations, Holding Companies or very high incomes and wealth to manage.

For example, someone might want to know if they can retire in three years or what is the earliest they can retire given their circumstances, hopes and dreams. Others may want to maximize the size of their Estates or provide for disabled children and so on.

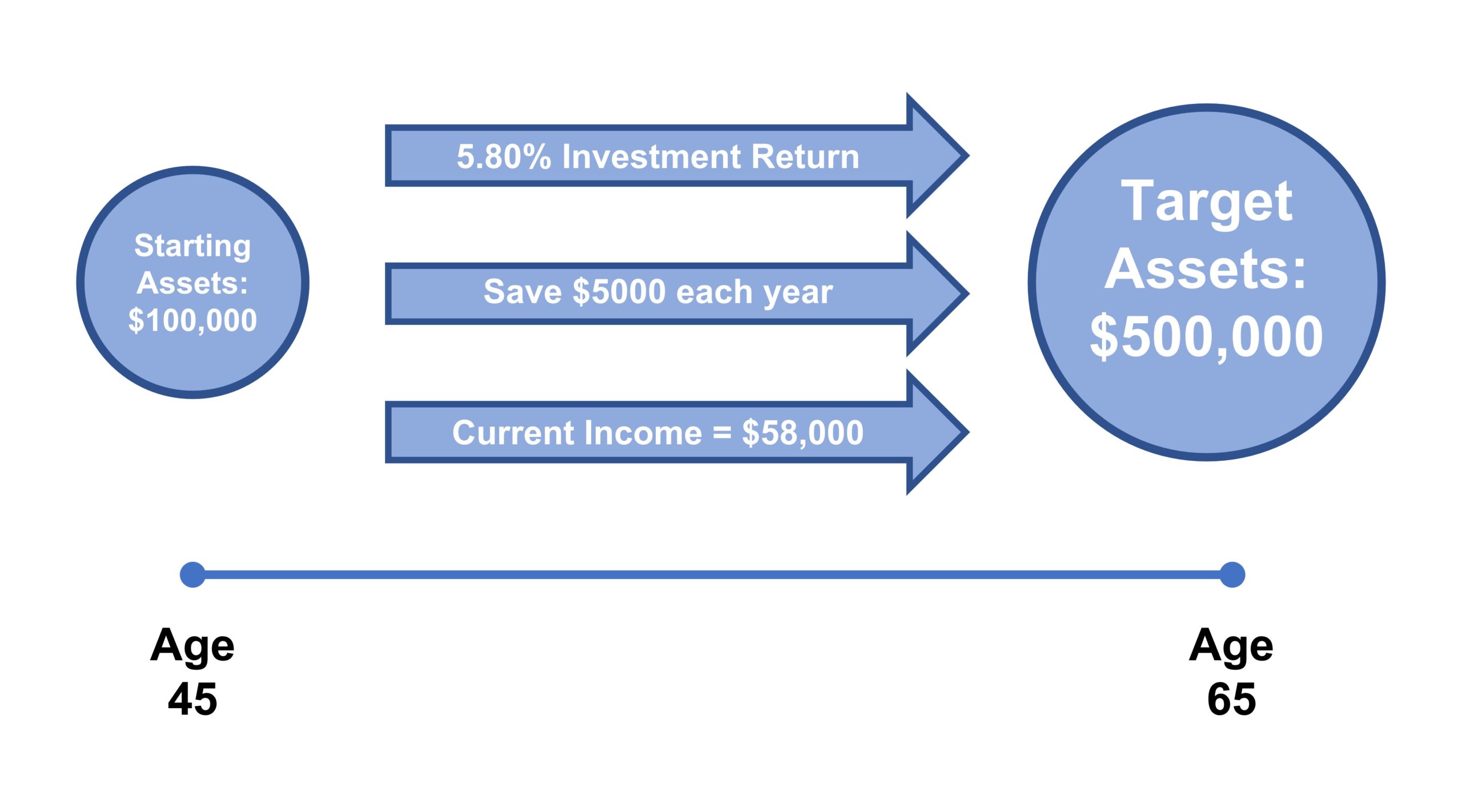

For most people a Target-Based approach to planning and building savings is the simplest approach.

This target approach simplifies all decisions into one dollar amount over an individual’s career in preparation for retirement and helps in knowing whether they are on track or not to meet their goals and dreams.

The focus is on an asset target level. This asset target will be achieved from a combination of savings and investment returns interest, dividends and capital gains over your career. It will also depend upon your current and expected earned income and desired lifestyle once you retire.

Most people use the terms financial independence and retirement interchangeably to mean the same thing.

They can be the same thing, but you can also be financially independent or doing the things that will lead you to become financially independent without actually being retired.

Let’s take an example using the Statistics Canada average Canadian Sue, who reports income of $58,000 annually and wishes to retire on a $29,000 annual pension:

Sue will need to save or generate additional assets over the remaining 20 years of her career of $400,000 or $20,000 annually to hit her target. She can measure her progress using milestones along the way such as $250,000 in assets.

If Sue can save that each year out of her gross income she will easily reach her goals. If she is only able to save $4,000 annually, she will need to consider some other tactics to get her as close as possible to her ideal situation.

This is where a discussion with a financial advisor is important.

They can look at Sue’s savings rate, include company pensions or CPP and OAS in her asset target mix and review her investment strategy and so on. Talk to your advisor today about your specific situation.

Questions about retirement planning?

Contact our office today

Copyright © AdvisorNet Communications Inc., under license from W.F.I. All rights reserved. This article is provided for informational purposes only and is not intended to provide specific financial advice. It is strongly recommended that the reader seek qualified professional advice before making any financial decisions based on anything discussed in this article. This article is not to be copied or republished in any format for any reason without the written permission of the publisher. The publisher does not guarantee the accuracy of the information and is not liable in any way for any error or omission.