When it comes to flexible investment tools, there’s nothing quite like a Tax-Free Savings Account (TFSA). This registered account allows you to hold not just savings but also investment equities like stocks, bonds, mutual funds and GICs. All of your investments grow tax-free in a TFSA. What’s even better? You’re not taxed when you make withdrawals, and you can reinvest that amount in future years.

If you’re thinking about contributing to a TFSA in 2021, that’s excellent news. However, you may be a bit confused about how much you are allowed to contribute. You’re not alone in your confusion. TFSA contribution room is indexed for inflation, so limits vary by year (see Table 1). For 2021, that limit is $6000, but if you’ve never contributed to a TFSA before or haven’t invested the maximum amount in previous years, you can carry forward unused amounts.

What’s Your Contribution Room This Year?

If you’d like to invest in a TFSA this year but aren’t sure how much you’re allowed to contribute, here is a straightforward way to determine your limit for 2021.

If You’re Investing In A TFSA For The First Time

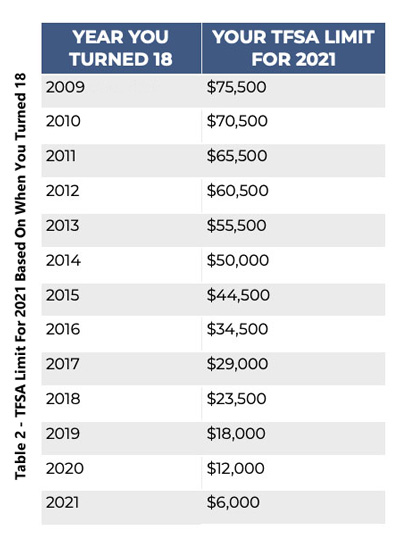

Using Table 2, find the year you turned 18. The corresponding limit is what you are allowed to contribute to a TFSA in 2021 – unless you live in BC, NL,NS or NB. In these provinces you can accumulate TFSA room as of age 18 but are not eligible to open a TFSA account until age 19.

If You Have A TFSA From Previous Years

Use the information in Table 2, along with the formula below, to determine what you are allowed to contribute this year:

- Choose the year you turned 18 and the corresponding TFSA limit for 2021.

- Add any previous withdrawals made since 2009 or the year you turned age 18.

- Subtract all of your previous contributions from earlier years.

- The resulting number is this year’s contribution room.

Understand The Potential Of TFSAs In Reaching Your Financial Goals

Whether you’re opening a TFSA for the first time, want to know how much you can add to your existing TFSA or would like to understand the role that TFSAs could play in your bigger financial picture, it’s always a good idea to speak with an expert.

CONTACT OUR OFFICE to learn more about how TFSAs could help you reach your savings goals.

Table 1TFSA Limit Calculator

Table 2 https://www.investmentexecutive.com/news/industry-news/2021-tfsa-limit-announced/

Copyright © 2021 AdvisorNet Communications Inc. All rights reserved. This article is provided for informational purposes only and is based on the perspectives and opinions of the owners and writers only. The information provided is not intended to provide specific financial advice. It is strongly recommended that the reader seek qualified professional advice before making any financial decisions based on anything discussed in this article. This article is not to be copied or republished in any format for any reason without the written permission of the AdvisorNet Communications. The publisher does not guarantee the accuracy of the information and is not liable in any way for any error or omission.